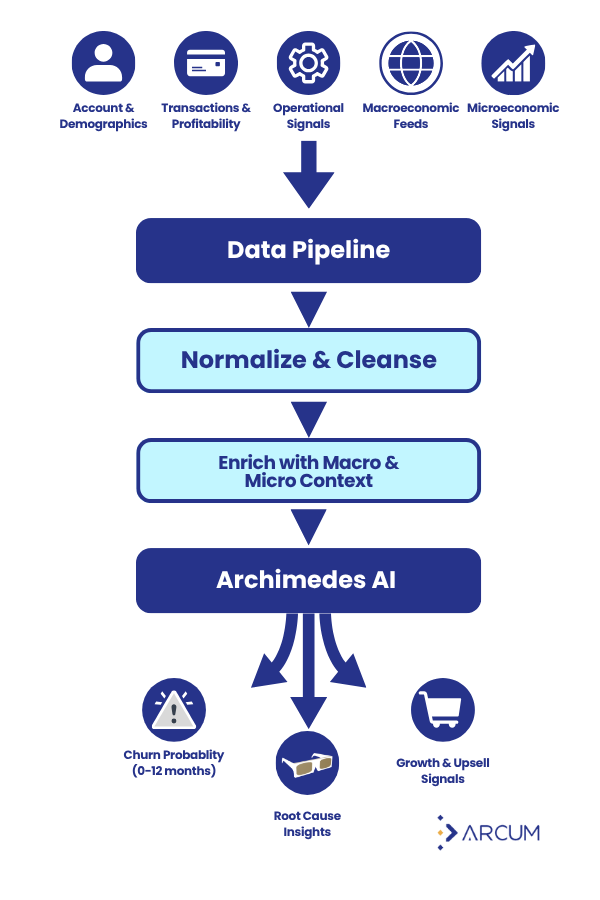

How Archimedes AI Works

A high-level look behind the scenes of Archimedes AI

Arcum Predictive Intelligence Powered by Archimedes AI

Archimedes AI specializes in predicting merchant behavior and uncovering the likely reasons behind it. This helps payments companies stay ahead of potential risks and seize new opportunities within their merchant portfolio.

Key Predictions

- Future Behavior Forecasting - How likely an active merchant is to churn within the next 12 months (or next quarter etc)

- Root Cause Analysis - Identifies probable drivers of that behavior, such as hardware issues or operational challenges

Core Data Inputs

Three categories of data that Archimedes ingests, include:

1) Account and Demographic Data-

- Processing period (monthly)

- Merchant account identifier (MID)

- Sub-ISO and agent identifiers

- Account lifecycle dates and status (approved, active, closed)

- Geographic info (state, zip code) and industry code

- Acquisition channel (direct agent referral digital)

- eCommerce flag and platform type

- Merchant network structure (standalone or chain)

-

- Volume and count by card brand (Visa, Mastercard, Discover, Amex, EBT, PIN debit, other)

- Returns count and volume by brand

- Monthly unique card count

- Card-not-present ratios for transactions and volume

-

- Authorization count and fee revenue

- Decline count and dollar amount

- Batch activity and related fee revenue and expense

- PCI processing costs and revenue

- Statement request timing

- Support ticket volumes by category (pricing service terminal)

- Equipment and terminal details, including EMV/NFC capabilities

- Pricing model (interchange plus bundled tiered)

Economic Enrichment

We layer in external and internal context by combining:

- Macroeconomic indicators such as regional GDP growth, unemployment rates and consumer sentiment to capture factors outside client control

- Microeconomic signals, including local market trends, competitive pricing moves, and service performance, are used to isolate the impact of internal policies vs outside factors

How Archimedes AI Works

Archimedes continuously analyzes vast amounts of data from transactions, economic feeds, and operational logs to detect patterns, relationships, and deviations that signal future outcomes:

- Dynamically evolving - Models learn and improve over time as data accumulates

- Not rule-based - Learns from data rather than following fixed business logic

- Superior pattern recognition - Detects emerging trends more effectively than manual analysis

- Statistical accuracy - Proven to be correct more often than not

- Focus on high-value accounts - Prioritizes insights that drive the greatest impact for revenue retention and growth

Archimedes isn’t just predicting the future; it’s reshaping how payments companies anticipate and act on merchant behavior.